What Is a Resale Certificate? The Complete Guide for 2025

If you're starting a retail business, selling on Amazon or eBay, flipping items for profit, or buying wholesale inventory, you've probably encountered the term "resale certificate." It's one of those business essentials that sounds complicated but is actually quite straightforward once you understand it.

In this comprehensive guide, we'll break down everything you need to know about resale certificates—from the fundamentals to state-specific requirements, common pitfalls, and expert tips for using yours effectively.

Whether you're a first-time entrepreneur or an experienced seller expanding to new states, this guide has you covered.

Understanding Resale Certificates

Understanding Resale Certificates

What Is a Resale Certificate?

A resale certificate (also known as a reseller's permit, resale license, sales tax exemption certificate, or seller's permit depending on your state) is an official document that allows your business to purchase goods tax-free when those goods are intended for resale to customers.

The Simple Explanation

Here's the concept in plain English: Sales tax is meant to be paid by the end consumer—the person who actually uses the product. When you buy something to resell, you're not the end consumer. Your customer is.

Without a resale certificate, here's what would happen:

- You buy a product from a wholesaler and pay sales tax

- You sell that product to a customer who also pays sales tax

- The same item gets taxed twice—that's not how sales tax is supposed to work

The resale certificate solves this by proving to suppliers that you're a legitimate business buying for resale, not personal use. They skip charging you sales tax, and you collect it from your customer instead.

What a Resale Certificate Is NOT

Let's clear up some common confusion:

-

It's NOT a business license – A business license gives you permission to operate in your city or county. A resale certificate is specifically about sales tax.

-

It's NOT a tax ID number – Your EIN (Employer Identification Number) identifies your business to the IRS. A resale certificate is a state-level document.

-

It doesn't exempt you from collecting sales tax – You still need to collect sales tax from your customers and remit it to the state. The certificate only exempts you from paying tax on items you buy to resell.

-

It's NOT a license to avoid all taxes – Using it for personal purchases is illegal tax fraud.

Key Takeaway: A resale certificate shifts the sales tax obligation from the wholesale transaction to the retail transaction, ensuring items are only taxed once—when sold to the final consumer.

Who Needs a Resale Certificate?

The short answer: anyone who buys products or materials with the intent to resell them. But let's get more specific.

Do You Need a Resale Certificate?

Do You Need a Resale Certificate?

Businesses That Definitely Need One

Retail Store Owners If you operate a brick-and-mortar store—whether it's a boutique, hardware store, grocery shop, or any other retail establishment—you need a resale certificate to purchase inventory from wholesalers and distributors tax-free.

E-Commerce Sellers Selling online doesn't exempt you from sales tax rules. If you sell on:

- Amazon (FBA or merchant fulfilled)

- eBay

- Etsy

- Shopify

- Walmart Marketplace

- Your own website

- Facebook Marketplace (for business purposes)

...you need a resale certificate to purchase inventory without paying sales tax.

Resellers and Flippers The reselling business has exploded in recent years. Whether you're flipping:

- Retail arbitrage finds

- Thrift store discoveries

- Clearance items

- Garage sale treasures

- Liquidation pallets

If you're doing this as a business (not just occasionally selling personal items), you need a resale certificate.

Dropshippers Even though you never physically touch the inventory, you're still the seller of record. When your supplier ships directly to your customer, you need a resale certificate to buy from that supplier tax-free.

Manufacturers If you manufacture products, you need a resale certificate to purchase raw materials, components, and parts that become part of your finished goods. The screws in your furniture, the fabric in your clothing, the ingredients in your food products—all can be purchased tax-free.

Wholesalers and Distributors If you buy products in bulk to sell to other businesses (who will then resell to consumers), you need a resale certificate for your purchases from manufacturers.

Less Obvious Cases

Service Providers (Sometimes) In some states, if you provide a service and transfer tangible property to your customer as part of that service, you may need a resale certificate. For example:

- A mechanic who installs parts

- A contractor who installs materials

- A salon that sells products used during services

Rental Businesses If you buy items specifically to rent or lease them to customers (equipment rental, party supply rental, etc.), you may qualify for tax-free purchases in many states.

Nonprofit Organizations While nonprofits often have separate tax exemption certificates, some use resale certificates for items they sell in gift shops, fundraisers, or other retail operations.

Quick Self-Assessment

Ask yourself these questions:

| Question | If Yes... |

|---|---|

| Will I buy items specifically to resell them? | You need a resale certificate |

| Will I buy materials that become part of products I sell? | You need a resale certificate |

| Do I need to open accounts with wholesalers or distributors? | You need a resale certificate |

| Will I sell products online, even occasionally? | You likely need a resale certificate |

| Am I buying items only for personal or business use (not resale)? | You do NOT need a resale certificate |

When You Don't Need One

- You're buying items for personal use

- You're buying office supplies, equipment, or fixtures for your business (not for resale)

- You're in a state with no sales tax (Alaska, Delaware, Montana, New Hampshire, Oregon)

- You're only selling services with no tangible goods transferred

- You're occasionally selling personal belongings (not operating as a business)

Benefits of Having a Resale Certificate

Getting a resale certificate isn't just a legal requirement—it's a strategic business advantage. Here's why it matters.

1. Significant Tax Savings

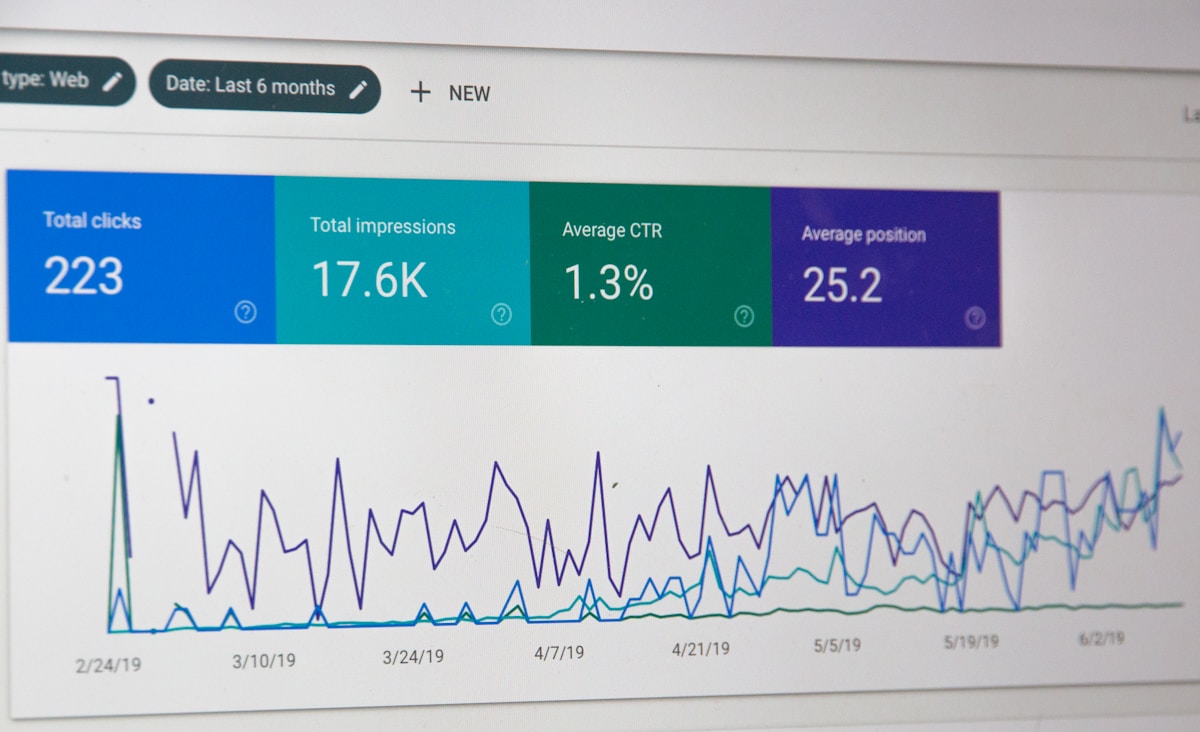

This is the most obvious and impactful benefit. Let's do the math:

Example Scenario:

- Monthly inventory purchases: $15,000

- State sales tax rate: 8.25%

- Monthly tax without certificate: $1,237.50

- Annual tax savings: $14,850

That's nearly $15,000 per year that stays in your business instead of going to sales tax on items you're going to resell anyway.

For high-volume sellers, the savings are even more dramatic:

| Monthly Inventory | Tax Rate | Annual Savings |

|---|---|---|

| $5,000 | 7% | $4,200 |

| $15,000 | 8% | $14,400 |

| $50,000 | 8.25% | $49,500 |

| $100,000 | 9% | $108,000 |

2. Access to Wholesale Suppliers

Here's something many new business owners don't realize: most legitimate wholesalers won't sell to you without a resale certificate.

Why? Because they need proof that you're a real business buying for resale. Otherwise, they could be liable for uncollected sales tax, and they'd be undercutting their retail partners.

With a resale certificate, you can:

- Open accounts with major distributors

- Access wholesale pricing (often 30-50% below retail)

- Buy directly from manufacturers

- Use wholesale marketplaces like Faire, Abound, and Tundra

- Access trade shows and wholesale showrooms

3. Better Profit Margins

When you're not paying sales tax on inventory AND you're getting wholesale pricing, your profit margins improve dramatically.

Without Resale Certificate:

- Buy item at retail: $50 + $4 tax = $54

- Sell for: $75

- Profit: $21 (28% margin)

With Resale Certificate:

- Buy item at wholesale: $30 + $0 tax = $30

- Sell for: $75

- Profit: $45 (60% margin)

That's more than double the profit margin on the same sale.

4. Business Credibility

A resale certificate signals to suppliers, partners, and even customers that you're running a legitimate operation. This credibility opens doors:

- Better vendor relationships – Suppliers take you more seriously

- Net payment terms – Instead of paying upfront, you may qualify for Net-30 or Net-60 terms

- Exclusive access – Some brands only work with credentialed retailers

- Negotiating power – Legitimate businesses can negotiate volume discounts

5. Legal Protection

Operating without a resale certificate when you need one exposes you to serious risks:

- Back taxes – States can audit you and demand sales tax you should have paid

- Penalties and interest – These can add 25-50% to what you owe

- Fraud charges – In extreme cases, intentional tax evasion is a crime

- Supplier issues – Suppliers who sold to you tax-free without proper documentation could come after you

Having your certificate in order means you're protected if audited.

Benefits of Resale Certificates

Benefits of Resale Certificates

What Can You Buy With a Resale Certificate?

Your resale certificate is powerful, but it's not a blank check for tax-free shopping. Understanding what qualifies—and what doesn't—keeps you legal and audit-proof.

Items You CAN Buy Tax-Free

✅ Finished Goods for Resale Any tangible product you buy specifically to resell in the same condition:

- Clothing and accessories

- Electronics and gadgets

- Home goods and furniture

- Books, toys, and games

- Food products (for resale, not consumption)

- Health and beauty products

✅ Raw Materials and Components Items that become part of a product you manufacture and sell:

- Fabric for clothing manufacturers

- Wood for furniture makers

- Ingredients for food producers

- Electronic components for device assemblers

- Packaging materials (boxes, labels, bags)

✅ Items for Rental or Lease Products you purchase specifically to rent to customers:

- Equipment rental inventory

- Party supplies (tables, chairs, tents)

- Tool rental stock

- Costume and formal wear rentals

✅ Items Transferred to Customers in Service In many states, items that become the customer's property as part of a service:

- Auto parts installed by a mechanic

- Materials installed by a contractor

- Products applied during salon services

✅ Taxable Services on Inventory Services performed on items in your resale inventory:

- Alterations to clothing you'll sell

- Repairs to equipment you'll resell

- Assembly services for products you'll sell

Items You CANNOT Buy Tax-Free

🚫 Personal Use Items Anything you'll use personally, even if you own a business:

- Clothes you wear

- Food you eat

- Electronics you use

- Furniture for your home

🚫 Business Use Items (Non-Resale) Items for running your business that you won't sell:

- Office supplies (paper, pens, printer ink)

- Computer equipment for your use

- Store fixtures and displays

- Cleaning supplies

- Tools and equipment you use (not sell)

🚫 Items Given Away Free Promotional items, gifts, or giveaways don't qualify:

- Free samples

- Promotional merchandise

- Customer gifts

- Contest prizes

🚫 Items for Internal Consumption

- Break room snacks and beverages

- Supplies consumed in manufacturing (cleaning solvents, lubricants)

- Items used and disposed of in your operations

The Gray Areas

Some situations require careful consideration:

Dual-Use Items What if you buy printer ink, but you sell printer ink AND use it in your office? The portion for resale qualifies; the portion for personal use doesn't. Keep records of how you allocate these purchases.

Demo and Display Items An item you display in your store can usually be purchased tax-free IF you intend to sell it eventually. But if it's a permanent fixture, it doesn't qualify.

Damaged or Returned Goods If you purchase items for resale but end up keeping damaged goods for personal use or business use, you technically owe use tax on those items.

Pro Tip: When in doubt, pay the tax. The cost of paying sales tax on a questionable item is far less than the penalties and hassle of an audit finding you used your certificate improperly.

How to Get a Resale Certificate

The process for obtaining a resale certificate varies by state, but the general framework is similar. Here's your roadmap.

Step 1: Determine Your State Requirements

Before you apply, understand what your state calls it and what's required:

| State Term | States That Use It |

|---|---|

| Resale Certificate | Most states |

| Seller's Permit | California, Texas |

| Sales Tax License | Colorado, Louisiana |

| Retail License | Alabama |

| Certificate of Authority | New York, Ohio |

Some states (like California and Texas) automatically issue a resale certificate when you register for a seller's permit. Others require a separate application.

Step 2: Gather Required Information

Have this information ready before you start:

Business Information:

- Legal business name

- DBA (Doing Business As) name, if applicable

- Business address

- Business phone number

- Business email

- Type of entity (Sole Proprietor, LLC, Corporation, Partnership)

- Date business started or will start

Owner/Officer Information:

- Full legal name(s)

- Social Security Number(s) or ITIN(s)

- Home address(es)

- Driver's license number(s)

- Ownership percentages

Tax Information:

- EIN (Employer Identification Number) – required for most entities except sole proprietors

- Social Security Number (if sole proprietor without EIN)

- State tax ID numbers from other states (if applicable)

Business Activity Details:

- Description of products you'll sell

- NAICS code (industry classification)

- Estimated monthly/annual sales

- Whether you'll sell online, in-store, or both

- Whether you'll have employees

Step 3: Choose Your Application Method

Option A: Apply Directly With Your State

- Visit your state's Department of Revenue website

- Find the sales tax registration section

- Complete the online application (most states offer this)

- Some states still require paper applications

Pros: No third-party fees Cons: Navigating government websites, potential errors, longer processing

Option B: Use a Registration Service Services like ResaleCertificate.org handle the process for you:

- We gather your information through a simple questionnaire

- Our team reviews everything for accuracy

- We submit to the state on your behalf

- We handle any follow-up or corrections needed

Pros: Faster, fewer errors, expert guidance Cons: Service fee (but often worth it for time saved)

Step 4: Submit and Wait

Processing times vary significantly by state:

| Processing Time | States |

|---|---|

| Instant (online) | Texas, Florida, many others |

| 1-3 business days | California, New York |

| 1-2 weeks | Some paper-only states |

| 2-4 weeks | States with backlogs |

With ResaleCertificate.org, we process applications within 24-48 hours after verification.

Step 5: Receive and Store Your Certificate

Once approved, you'll receive:

- A certificate number or permit number

- An official certificate document (digital and/or paper)

- Instructions for renewals (if applicable)

Important: Store your certificate securely and keep copies:

- Digital copy on your phone

- Copy in your wallet or vehicle

- Scanned backup in cloud storage

- Physical copy in your business records

Getting Your Resale Certificate

Getting Your Resale Certificate

State-by-State Requirements

Not all states play by the same rules. Here's what you need to know about state-specific requirements.

States Requiring In-State Registration

These states generally do not accept out-of-state resale certificates. You must register within the state to make tax-free purchases there:

- Alabama – Requires Alabama sales tax license

- California – Requires California seller's permit

- Florida – Requires Florida Annual Resale Certificate

- Hawaii – Requires Hawaii GET license

- Illinois – Requires Illinois registration

- Louisiana – Requires Louisiana resale certificate

- Maryland – Requires Maryland registration

- Massachusetts – Requires Massachusetts registration

- Washington – Requires Washington registration

- Washington D.C. – Requires D.C. registration

If you're buying from suppliers in these states or have nexus there, you'll need to register specifically with that state.

Streamlined Sales Tax States

These 24 states participate in the Streamlined Sales Tax (SST) program, which simplifies multi-state registration:

Alabama, Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin, Wyoming

Through SST, you can register in all participating states with a single application at sstregister.org.

No Sales Tax States

These states don't have a general sales tax, so resale certificates aren't needed for purchases there:

- Alaska – No state sales tax (some local taxes exist)

- Delaware – No sales tax

- Montana – No sales tax

- New Hampshire – No sales tax

- Oregon – No sales tax

However, if you're based in one of these states but sell to customers in states with sales tax, you may still have sales tax obligations in those other states.

Certificate Expiration by State

Some states issue certificates that never expire; others require periodic renewal:

| Expiration | States |

|---|---|

| No Expiration | California, Texas, New York, and most others |

| Annual Renewal | Florida, New Mexico, Hawaii |

| Periodic Renewal | A few states require renewal every 3-5 years |

Always check your specific state's requirements and set renewal reminders.

Blanket Certificates vs. Single-Purchase Certificates

Blanket Certificates cover all future purchases from a specific vendor. You provide it once, and it stays on file.

Single-Purchase Certificates cover only one transaction. You must provide a new certificate for each purchase.

Most states allow blanket certificates, but some vendors prefer single-purchase documentation for their records.

How to Use Your Resale Certificate

Having a resale certificate is only valuable if you know how to use it properly. Here's your practical guide.

Using It With Wholesale Suppliers

Initial Setup:

- When opening a new wholesale account, provide a copy of your resale certificate

- Fill out any vendor-specific resale certificate forms they require

- Include your state tax ID number and business information

- The supplier will keep this on file for future orders

Ongoing Purchases:

- Most suppliers honor your certificate for all future purchases once it's on file

- Some may ask you to re-certify annually or with each order

- Always confirm tax-exempt status before completing large orders

Using It on Major Platforms

Amazon (for Seller Central users)

- Log into Seller Central

- Go to Settings → Tax Settings

- Navigate to "Tax Exemption Program"

- Upload your resale certificate(s)

- Amazon will review and apply exemptions

Walmart Marketplace

- Access your Partner Center

- Go to Settings → Tax Information

- Upload your resale certificate

- Wait for verification (usually 1-3 business days)

Alibaba and International Suppliers

- International purchases typically aren't subject to U.S. sales tax anyway

- However, if buying from a U.S.-based Alibaba seller, your certificate applies

- Some suppliers may request it for their records regardless

eBay (for Business Purchases)

- eBay's tax exemption program (STEP) allows registered businesses to make tax-free purchases

- Enroll at ebay.com/tax-exemption

- Upload your resale certificate for each state

Using It In-Person

At Wholesale Cash & Carry Stores:

- Present your certificate when you check out

- The cashier will apply the tax exemption

- You may need to present ID matching your certificate

- Some stores require you to register your certificate in their system first

At Trade Shows:

- Bring multiple copies of your certificate

- Each vendor will need their own copy

- Some trade shows have expedited registration for credentialed buyers

At Retail Stores (for Resale Purchases):

- Yes, you can use your certificate at regular retail stores if buying for resale

- Not all stores accept them—call ahead for large purchases

- The store may require manager approval

Record Keeping Best Practices

Protect yourself in case of an audit:

Keep Records Of:

- Copies of all resale certificates you've issued to suppliers

- Invoices showing tax-exempt purchases

- Documentation of what you did with those items (sold, returned, etc.)

- Any certificates you've received from YOUR customers

How Long to Keep Records: Most states require you to keep sales tax records for 3-7 years. When in doubt, keep them for at least 7 years.

Organization System:

- Create a folder (physical or digital) for each vendor

- Store the certificate you gave them

- Keep all tax-exempt invoices from them

- Note the date you provided the certificate

Common Mistakes to Avoid

Even well-meaning business owners make mistakes with resale certificates. Here's what to watch out for.

Mistake #1: Using It for Personal Purchases

The Problem: You're at Costco with your resale certificate. You're buying inventory, but you also throw in some snacks for yourself and claim the whole purchase as tax-exempt.

Why It's Serious: This is tax fraud. States actively audit for this, and the penalties include:

- Back taxes on all personal items

- Penalties of 25-50% of taxes owed

- Interest charges

- Potential criminal charges for intentional fraud

- Revocation of your certificate

The Solution: Keep personal and business purchases completely separate. Use different payment methods, shop at different times, or simply pay tax on personal items.

Mistake #2: Using an Expired Certificate

The Problem: You obtained your certificate years ago and haven't checked whether it needs renewal. You've been using an expired certificate.

Why It's Serious: Purchases made with an expired certificate aren't legally tax-exempt. The supplier could be held liable, and you could owe back taxes.

The Solution:

- Check your state's renewal requirements

- Set calendar reminders 60 days before expiration

- Update all vendors with your renewed certificate promptly

Mistake #3: Not Keeping Proper Records

The Problem: You know you made tax-exempt purchases, but you don't have documentation proving what you bought, who you bought it from, or that you resold those items.

Why It's Serious: In an audit, the burden of proof is on YOU. Without records, the state can assess taxes on all your purchases.

The Solution:

- Keep copies of every certificate you issue

- Maintain organized invoices

- Track inventory from purchase to sale

- Use accounting software that tracks tax-exempt purchases

Mistake #4: Using the Wrong State's Form

The Problem: You're a California business buying from a Texas supplier. You give them your California resale certificate.

Why It's Serious: Texas is one of the states that requires their own certificate. Your California certificate may not be valid for Texas purchases.

The Solution:

- Know which states accept out-of-state certificates

- Register in states that require it (especially if you buy there frequently)

- Ask suppliers which form they need

Mistake #5: Failing to Register When Required

The Problem: You're making sales in a state but haven't registered for a sales tax permit there because "it's just online sales."

Why It's Serious: Economic nexus laws mean you likely need to register in states where you have significant sales, even without physical presence. Most states set thresholds around $100,000 in sales.

The Solution:

- Understand nexus rules for each state

- Track sales by state

- Register proactively when approaching thresholds

- Consider using sales tax automation software

Mistake #6: Not Collecting Sales Tax from Customers

The Problem: You think the resale certificate means you don't have to deal with sales tax at all.

Why It's Serious: You absolutely must collect sales tax from your customers (in most cases) and remit it to the state. The certificate only affects what YOU pay.

The Solution:

- Set up proper sales tax collection on all sales channels

- File and remit sales tax on schedule

- Use tools like TaxJar or Avalara to automate compliance

Frequently Asked Questions

General Questions

How much does a resale certificate cost? State filing fees range from $0 to about $50 depending on the state. Third-party services like ResaleCertificate.org charge additional fees for assistance, review, and faster processing—typically $50-150.

How long does it take to get a resale certificate? Direct state applications: instant to 4 weeks depending on the state and method. With ResaleCertificate.org: 24-48 hours after verification for most states.

Do resale certificates expire? It depends on the state. Most certificates don't expire as long as your business remains active. Florida, New Mexico, and Hawaii require annual renewal. Always check your specific state's requirements.

Can I use one resale certificate in multiple states? Generally, no. Each state requires its own certificate or registration. However, many states accept out-of-state certificates for one-time purchases, and the Streamlined Sales Tax program simplifies multi-state registration.

Application Questions

What if I don't have an EIN? Sole proprietors can often use their Social Security Number instead. For other entity types (LLC, Corporation), you'll need to obtain an EIN from the IRS first—it's free and can be done online at irs.gov.

Can I apply if I'm just starting my business? Yes! Many states allow you to register before you make your first sale. You'll estimate your expected sales volume on the application.

What if I was denied? Denials are usually due to incomplete information, errors, or issues with your business registration. Review the denial reason, correct any issues, and reapply. A service like ResaleCertificate.org can help identify and fix problems.

Usage Questions

What if a supplier refuses to accept my certificate? Suppliers have the right to refuse tax-exempt sales. This could happen if:

- Your certificate is expired or invalid

- They require a different form

- Their policy requires tax on all sales Try providing additional documentation, ask what they specifically need, or find an alternative supplier.

Can I use my resale certificate at regular retail stores? Yes, but not all retailers accept them. Large retailers like Costco and Sam's Club have established programs. For others, call ahead—especially for large purchases.

Do I need to show my certificate for every purchase? Depends on the vendor. Most wholesale suppliers keep your certificate on file after the first purchase. Some require it annually or with each order. Retail stores typically need it for each transaction.

Compliance Questions

What happens if I'm audited? The state will review your records to ensure you:

- Only used your certificate for legitimate resale purchases

- Collected and remitted sales tax from your customers properly

- Kept adequate documentation

If you've been compliant, audits are simply paperwork. If issues are found, you may owe back taxes, penalties, and interest.

Can I lose my resale certificate? Yes. Certificates can be revoked for:

- Fraudulent use (personal purchases, false information)

- Failure to file sales tax returns

- Failure to pay sales tax you've collected

- Business closure or abandonment

What's the difference between sales tax and use tax? Sales tax is collected at the point of sale. Use tax is owed when you buy something without paying sales tax (like from an out-of-state vendor) but use it in your state. If you buy office furniture from a state with no sales tax and use it in California, you owe California use tax.

Ready to Get Started?

Getting your resale certificate doesn't have to be complicated. At ResaleCertificate.org, we've helped over 50,000 businesses obtain their certificates quickly and correctly.

Here's what we offer:

- ✅ Simple online application (5-10 minutes)

- ✅ Expert review to prevent errors and delays

- ✅ 24-48 hour processing for most states

- ✅ Dedicated support throughout the process

- ✅ Help with multi-state registrations

Stop paying unnecessary sales tax on your inventory. Start maximizing your profit margins today.

Apply for Your Resale Certificate →

Have questions our FAQ didn't answer? Our support team is here to help. Contact us for personalized assistance, or explore our state-by-state guides for specific requirements in your state.